Founded in 1985, we've grown to become one of the most trusted names in energy investments. Our portfolio includes interests in major oil fields, shale gas operations, LNG facilities, and refining capacity across six continents. We maintain strategic partnerships with national oil companies and independent operators alike, giving our investors access to opportunities typically reserved for industry insiders. Our investment approach combines fundamental analysis of geological potential with rigorous financial modeling to deliver consistent returns across market cycles.

High-potential investments in new oil and gas discoveries, with rigorous geological assessment and risk management protocols.

Established producing fields with predictable cash flows and reserves-based lending opportunities.

Pipelines, storage terminals and processing facilities that generate stable, fee-based returns.

Our growth in becoming one of the largest alternative investment managers is aligned with this vision and is a testament to our shared values, experienced management team, and focus on performance and high-quality investor base, which includes large asset management , trading , Infrastructures, sovereign wealth funds and financial planning.

Fossil and Fortune Oil & Gas Investments provides sophisticated energy sector investment strategies to institutional and private investors worldwide. Through our specialized investment vehicles, we offer access to exploration projects, producing assets, energy infrastructure, and commodity trading opportunities. Our consistent performance through multiple energy price cycles has established us as a leader in oil and gas investments

At Fossil and Fortune, we combine technical evaluation of oil and gas assets with rigorous financial analysis. Our team includes petroleum engineers and geologists who conduct on-site due diligence, evaluating reservoir characteristics, production potential, and operational risks. This technical foundation informs our investment decisions, allowing us to identify undervalued assets and emerging opportunities in global energy markets.

Our energy investment approach focuses on assets with identifiable value drivers - proven reserves, infrastructure advantages, or operational improvements. We prioritize investments with multiple paths to value realization, whether through production growth, reserve additions, or strategic sales. Our portfolio is structured to balance high-growth exploration opportunities with stable, cash-flowing production assets, providing investors with both current income and long-term appreciation potential.

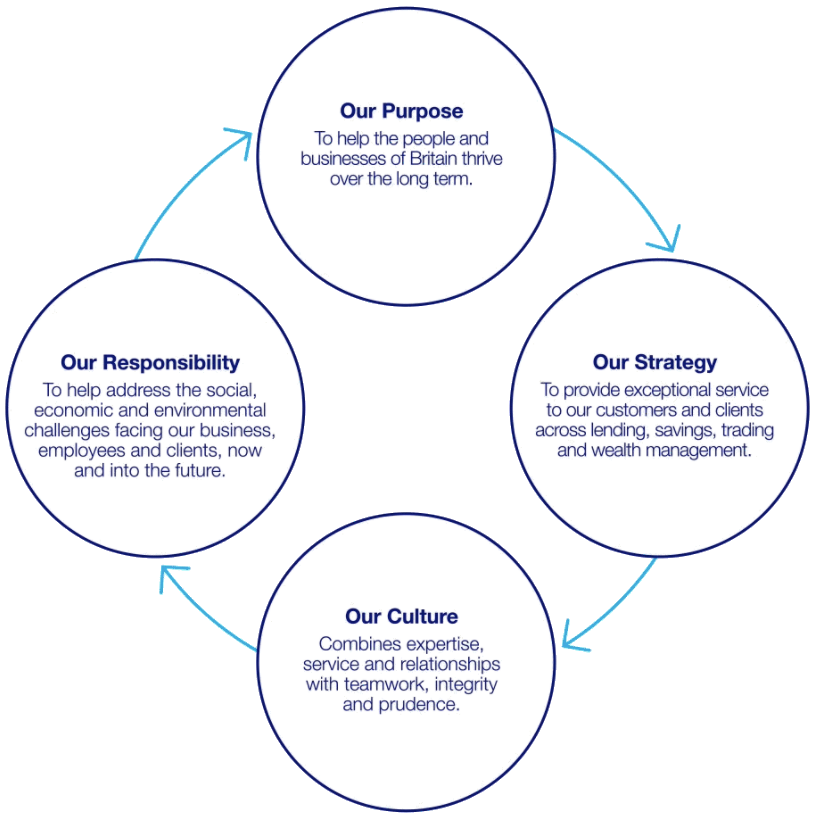

Fossil and Fortune Partners is committed to conducting business in a safe, responsible, and ethical manner. These principals guide our decision-making throughout the investment lifecycle.

From the onset of the investment process, we pursue ideas inspired by environmental, social, and governance ('ESG') issues and participate in industries engaged with these themes. All companies in which we invest are first vetted by our professionals, who work closely with expert advisors, to identify and mitigate potential ESG conflicts. Our ESG due diligence program requires an assessment of ten key ESG areas which may impact the current or future performance of a company. Fossil and Fortune will forego any investment that fails to meet its ESG standards.

Once invested, Fossil and Fortune reviews and monitors all its portfolio companies to ensure they adhere to its ESG policy, which is periodically reviewed to incorporate best practices as risks evolve. This process allows Fossil and Fortune to quickly detect and preempt or manage any difficulties that may arise during the investment period.

As investments mature, Fossil and Fortune seeks to continually improve upon ESG reviews and recommendations, and, together with management, works to ensure that ESG issues are prioritized through to and beyond exit.

You will earn 28.9% of their investments for 7 days.

You will also earn 10% of the affiliates investments.

Minimum

Maximum

You will earn 42.70% of their investments for 7 days.

You will also earn 7% of the affiliates investments.

Minimum

Maximum

You will earn 55.80% of their investments for 7 days.

You will also earn 10% of the affiliates investments.

Minimum

Maximum

You will earn 250% of their investments for 5 days.

You will also earn 20% of the affiliates investments.

Minimum

Maximum

You will earn 12% of their investments for 7 days.

You will also earn 10% of the affiliates investments.

Minimum

Maximum

Time is a precious commodity. Researching investments in ever-changing markets and handling investment transactions are more than most people have time for. Fossil and Fortune's Asset Management Solutions program allows you to delegate the daily management of your assets and invest with confidence, knowing that your portfolio is in the hands of experienced professionals.

At Fossil and Fortune we recognize that each investor is unique. That's why we take a personalized approach to developing an asset management strategy by selecting investment portfolios that closely match your goals, tolerance for risk, and expectation for returns.

A solid Wealth Plan ensures you have a financial strategy that supports your aspirations. Once we understand your lifestyle goals, we look at the current path of your finances to ensure that you are on track to meet them through retirement and beyond.

At the heart of our business are our partners: the entrepreneurs and management teams we back; the investors in our funds; the advisers and intermediaries we work with; and the banks and other lending institutions to our deals.

We strive to build world-class businesses to generate superior returns for our partners.

We are here to win. We are constantly improving, and are committed to out-thinking and out-executing our competitors. We take on what others dismiss as impossible, and solve the hard problems that others walk away from. This is why we hire the best.

We do things the right way, without compromise, the first time - every time. We are direct, decisive and, above all, accountable. We practice sound judgment and common sense in our actions that conforms to the letter and spirit of the law at all times. We win on the merits, with integrity.

We are driven by a thirst for knowledge. We are constantly learning - from each other and from inspired thinkers around the world. We passionately pursue new ideas, new innovations and new strategies that will strengthen our competitive advantage.

Fossil and Fortune is a tightly knit group working together with management teams toward common goals. We have more than 70 investment professionals, including 24 partners with an average tenure at Fossil and Fortune of more than a decade. This allows us to devote substantial time to the companies in which we invest.

Our objective is to work with portfolio company leadership and create a backdrop in which companies can thrive. We encourage management teams to invest alongside us, and our forward-thinking approach and philosophy to leave companies better than when we found them also means that portfolio company employees often choose to invest alongside Fossil and Fortune as well.

We believe that people thrive when they are working toward a common and focused goal. We are proud of our transparency and alignment of interest with our portfolio companies and investors. We believe our focus and significant skin in the game allows us to build true, successful partnerships.

Fossil and Fortune offers regional and global high-active-share equities, fixed income across the yield curve, liquidity solutions backed by four decades of experience as a core capability and, in private markets, real estate, infrastructure, private equity and private debt. Beyond investment management, Fossil and Fortune provides engagement in equity and bond markets, proxy voting and policy advocacy.

We exist to responsibly develop energy resources that power economies while protecting the environment and communities where we operate. Our purpose means helping investors participate in the global energy sector's growth while maintaining the highest standards of safety, environmental stewardship, and regulatory compliance. We build long-term partnerships with stakeholders to ensure sustainable energy development that benefits current and future generations.

To achieve this, we combine deep technical expertise in petroleum geology and engineering with disciplined financial analysis. Our team's decades of experience in upstream exploration, midstream infrastructure, and downstream operations allow us to identify the most promising opportunities while properly assessing risks. We focus on assets with strong fundamentals - proven reserves, operational advantages, and multiple paths to value creation - to deliver consistent returns regardless of commodity price cycles.

We believe in responsible energy development that balances economic, environmental and social considerations. Our approach combines cutting-edge extraction technologies with rigorous environmental protections and community engagement. This commitment to sustainable operations has earned us recognition as a leader in responsible energy investing.

We recognize the energy transition underway and are committed to investing in both traditional hydrocarbons and emerging clean energy technologies. Our strategy focuses on assets that will remain essential during this transition while positioning our investors to benefit from evolving energy markets.

Our Buyout Funds' portfolio can be qualified as 'asset light' and the most material environmental indicator for many companies is electricity usage.

Processes and practices are in place across the portfolio to support the wellbeing of the workforce.

Good corporate governance and a code of ethics which guides our business activities is the foundation of effective corporate management.

We focus on attracting exceptionally talented people and rewarding initiative, independent thinking and integrity. Our team's breadth of skills and deep expertise are a critical source of intellectual capital.

Investing across regions, industries and asset classes gives us the knowledge, resources and critical mass to take advantage of opportunities on a global scale.

Our performance is characterized by superior risk-adjusted returns across a broad and expanding range of asset classes and through all types of economic conditions.